TaxCatalyst Income Tax Prep

Prepare, e-file, and print your federal individual Income tax return for FREE. Get your refund now! Simple and easy to use, and now updated for Tax Year 2017 (for filing in 2018).

Are your federal taxes too complicated for those “snap a photo and file” apps, but you don’t want to hire an expensive CPA and pay hundreds of dollars? TaxCatalyst is for you! Itemize deductions, child tax credits, interest income and more! Get the tax refund you deserve.

- E-File your Federal return FREE. No purchase necessary.

- Estimate and calculate your taxes for FREE.

- FREE paper/PDF tax returns for Federal and/or State. No purchase necessary. No exceptions. Its FREE for EVERYONE.

- None of the upselling thats common in the industry. We only have honest, straightforward pricing. The only paid service we offer is State E-File. Everything else is FREE.

INCLUDES:

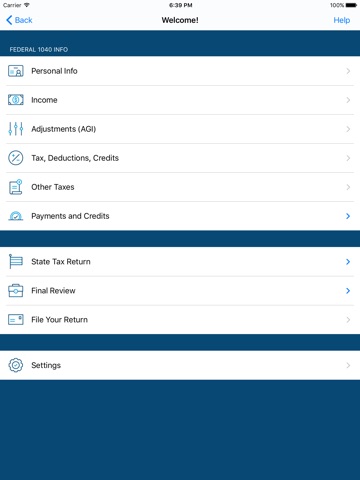

- Federal income tax return IRS Form 1040 (Tax Year 2017)

- California state tax return CA Form 540 (Tax Year 2017)

- Itemized deductions (including home mortgage interest deduction)

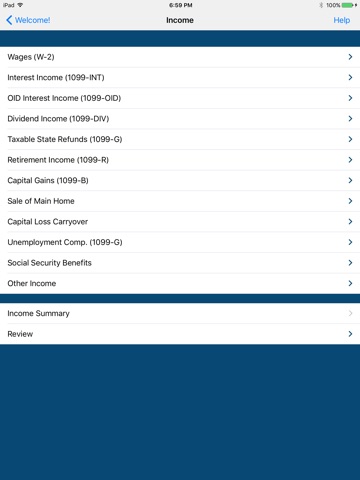

- Capital gains and losses, home sale

- Retirement income, social security, unemployment, W-2, 1099-R, 1099-G

- Dividends 1099-DIV, interest 1099-INT, 1099-OID

- IRA deduction, educator expenses, alimony

- Education credits, student loan interest, tuition deduction

- Alternative Minimum Tax (AMT) basic support

- Health coverage and premium tax credit

- Child and Dependent Care Credit

- Child tax credit, retirement savers credit

- Earned income credit for federal + CA

- Plus more! See our web page for a list of supported forms.

NO USER ACCOUNTS: Unless you enable multi-factor authentication, other companies leave the door open for hackers to login and steal your info and refund. Other companies expose your data to hackers by sharing personal info with third parties. Security and privacy are at the core of our design. Thats why we chose not to have user accounts and why we never share your data with third party vendors.

You can even do all of your taxes offline – no internet connection needed unless you want to e-file.

Other features:

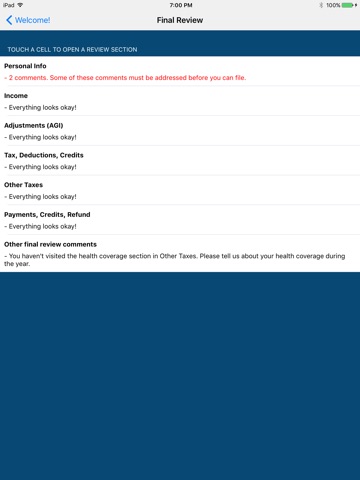

- Helpful messages to tell you when your data has errors or missing information.

- Backup and import from iCloud.

- Your data is easily imported from year to year.

- Create PDFs right on your device without an internet connection.

- PIN code to prevent unwanted editing of data. Can be enabled in settings.

Not currently supporting the following:

- Rental income (estimate only)

- Business and Self employment (estimate only)

- Community property when married filing separately

- K-1 Partnerships

- Investment expense deductions

- Foreign income and tax credit

- Tax underpayment penalties (but warning is given if applicable)

- Farm income (estimate only)

- Railroad retirement

- Nonresident Aliens

- HSA (not to be confused with FSA)

- State returns (other than California)

Free help by e-mail! We are an authorized IRS e-file provider.